take home pay calculator maine

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Your household income location filing status and number of personal exemptions.

Something Old Something New Maine Home Design Small Bedroom Remodel Kids Bedroom Remodel Remodel Bedroom

This payroll paycheck calculator is a fast and easy way to find out what your employee actual wages are per hour.

. How Income Taxes Are Calculated. This allows you to review how Federal Tax is calculated and Maine State tax is calculated and how those. In 2008 Maines per capita personal income was the 29th highest in the country at 36368 for every man woman and child in the state.

That means that your net pay will be 42787 per year or 3566 per month. You can calculate and compare your take home pay based on each salary. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to.

It can also be used to help fill steps 3 and 4 of a W-4 form. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

We want to take the horror out of your payroll tax duties so weve designed a nifty payroll calculator that can figure out all of the federal and Maine state payroll taxes for you and your employees. Next enter the hours worked per week and select the type of raise percentage increase flat rate. This Maine hourly paycheck calculator is perfect for those who are paid on an hourly basis.

But you may owe money on the property the average Maine homeowner still owes 140904. This calculator has been updated to use the new. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This free easy to use payroll calculator will calculate your take home pay. That means you could take home 220000 if you sell your home for 313134 and pay 106 to sell it.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If you make 55000 a year living in the region of New York USA you will be taxed 12213. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maine.

Enter your current pay rate and select the pay period. Here are all the most relevant results for your search about Take Home Pay Calculator Nyc. Follow the simple steps below and then click the Calculate button to see the results.

Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. Free Online Houly Paycheck Calculator for 2022. Maine Salary Paycheck Calculator.

Supports hourly salary income and multiple pay frequencies. This 4000000 Salary Example for Maine is based on a single filer with an annual salary of 4000000 filing their 2022 tax return in Maine in 2022. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Then enter the estimated total number of hours you expect to work and how much you are paid per hour. Maine 4000000 Salary Example.

Your average tax rate is 222 and your marginal tax rate is 361. Start by entering your current payroll information and any relevant deductions. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maine. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Individual Development Plan Toolkit.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The following is a concept Ive been working on that I call Maines Take-Home Pay which equals Maines per capita personal income minus per capita state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

All you have to do is input wage and W-4 information for each employee into the calculator and let it do the rest of the work. Use the following calculation tool to estimate your paycheck based on the stated hourly wages. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This calculator is intended for use by US. This marginal tax rate means that your immediate additional income will be taxed at this rate. 2021 Annual Pay w locality 2021 Bi-weekly Pay.

You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122. How to calculate annual income. Calculate your Maine net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maine paycheck calculator.

Calculating paychecks and need some help. Enter gross pay federal withholdings federalMaine state tax FIME and local deductions and exemptions as applicable - our Hourly Net Pay Payroll Calculator will do the rest. Use the Pay Raise Calculator to determine your pay raise and see a comparison before and after the salary increase.

Maine Hourly Paycheck Calculator. If you do your remaining mortgage balance will come out of your proceeds cutting into the amount that will finally land in your bank account. ICalculator also provides historical US Federal Income Tax figures so you can review how much tax you have paid in previous tax years or you can use our Salary Tax.

Please use our Advanced Calculator to calculate your net pay or. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Home Layered Lighting Design The Essential Guide For Every Room Design Lighting Design Household Hacks

In A Cold Winter Maine Household Budgets Buckle Under Growing Energy Burden Portland Press Herald

Maine Paycheck Calculator Smartasset

Drapery Measuring Guide With Calculator And Worksheet Custom Drapery Drapery Maine House

Simple Calculator Stroke Ad Paid Affiliate Stroke Calculator Simple Iphone Photo App Apple Logo Wallpaper Iphone Glitter Phone Wallpaper

Maine Estate Tax Everything You Need To Know Smartasset

Maine Sales Tax Small Business Guide Truic

Drapery Measuring Guide With Calculator And Worksheet Drapery Custom Drapery Maine House

Maine Property Tax Calculator Smartasset

Maine Paycheck Calculator Smartasset

Breakthrough Trend Harp M Mortgage Tips Home Mortgage Harp

Little To No Money Loans Exist Getting Preapproved For A Mortgage Is The First Step To Home Owner Mortgage Process Refinance Mortgage First Time Home Buyers

Pin By Mary Russell On Saving Maine House Saving

Maine Considers Student Debt Relief For First Time Buyers In 2022 Student Debt Relief Student Debt Student

Pin On Quaint Shops Eating Establishments

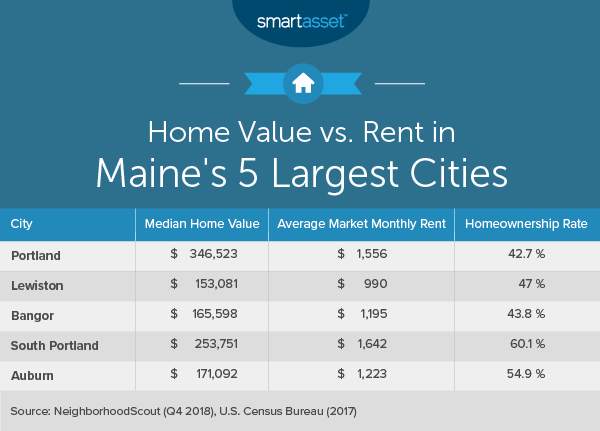

What Is The Cost Of Living In Maine Smartasset

2020 Minimum Wage Increases Affordable Bookkeeping Payroll Minimum Wage Wage Payroll

Text Bsm To 36260 Mortgage Calculator How To Apply Blue Stripes

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Mortgage Payment